💰 Sukanya Samriddhi Yojana ka Interest Rate 2025: Complete Guide in Hindi + Hinglish

Sukanya Samriddhi Yojana (SSY) ka 2025 interest rate kya hai? Benefits, eligibility, deposit rules, withdrawal options, step-by-step account opening guide + FAQs.

Contents

- 1 🌸 1. Sukanya Samriddhi Yojana (SSY) Kya Hai?

- 2 ⚡ 2. Interest Rate 2025 – Kitna Ho Sakta Hai?

- 3 💼 3. SSY Ke Benefits – Kya Milaega?

- 4 📌 4. Eligibility – Kaun Khulwa Sakta Hai?

- 5 🏦 5. Deposit Rules & Limits

- 6 💸 6. Withdrawal Rules

- 7 🔍 7. Interest Calculation Example

- 8 📝 8. Step-by-Step: SSY Account Kaise Kholen?

- 9 ✨ 9. Mera Experience

- 10 🏛️ 11. Official References:

- 11 ✅ 12. Key Takeaways

- 12 ❓ 10 FAQs – Aapke Sawalon Ke Jawab

- 13 🧩 Conclusion

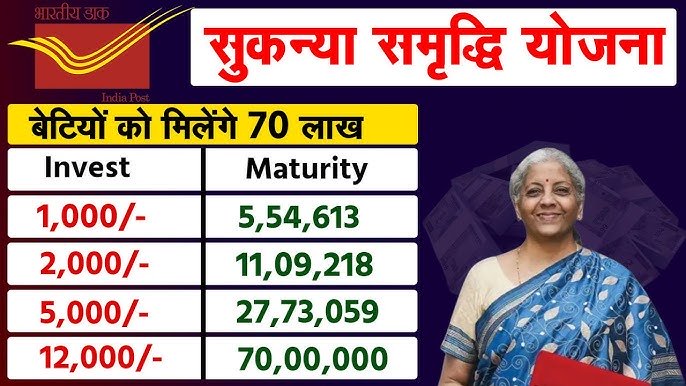

🌸 1. Sukanya Samriddhi Yojana (SSY) Kya Hai?

Sukanya Samriddhi Yojana ek government-backed long-term savings scheme hai, specially girl child ke liye. Iska main purpose hai unki education aur marriage ke liye financial security build karna.

Key Naam: ‘Save for Daughter’, ‘SSY Girl Child Plan’

⚡ 2. Interest Rate 2025 – Kitna Ho Sakta Hai?

2025–2026 ke liye current interest rate government ne announce kiya hai:

8.2% per annum (Compounded Annually)

📌 Official Sources: Notifications from Ministry of Finance aur [indiapost.gov.in] confirm.

“Interest rate is reviewed quarterly and currently set at 8.2% for Q2 FY 2025–26.”

💼 3. SSY Ke Benefits – Kya Milaega?

- High Returns: Bank FDs ke mukable kafi achha interest

- Risk-free: Full backing Government Guarantee ke saath

- Tax Benefit: Section 80C ke under tax exemption for deposit

- Picnic/Scholarship Aid: Education aur marriage ke important events ke liye support

- Compounding Power: Long-term savings grow significantly due to compounding

📌 4. Eligibility – Kaun Khulwa Sakta Hai?

- Girl child – maximum 10 saal ki umr tak eligible hai

- Account khol sakta hai parent ya legal guardian

- Only one SSY account per girl child allowed

- Deposit window: 21 saal tak ki umra tak continue rahegi

🏦 5. Deposit Rules & Limits

- Minimum yearly deposit: ₹250

- Maximum yearly deposit: ₹1.5 lakh

- Deposit window: First 10 life years only

- Missed deposit: Allowed with penalty of 50% of interest for that year (per RBI rules)

💸 6. Withdrawal Rules

- Partial Withdrawal: 18 saal ke baad – educational ya marriage purpose ke liye max 50%

- Premature Withdrawal: Exceptional cases (critical illness) – medical certificate required

- Closure: Girl turns 21 ya account maturity ke baad full withdrawal

🔍 7. Interest Calculation Example

Suppose ₹10,000/year deposit karte hain:

| Duration | Balance Estimate |

|---|---|

| 5 years | ~₹54,000 |

| 10 years | ~₹1.2 Lakh |

| 20 years | ~₹4.8 Lakh |

Compounded annual interest 8.2% par calculation

📝 8. Step-by-Step: SSY Account Kaise Kholen?

- Visit nearest post office ya select bank (eg. SBI, PNB)

- SSY form fill karein (Online bhi available)

- Documents: Girl’s birth certificate, guardian’s KYC (Aadhaar, PAN)

- Initial deposit ₹250 se start kare

- Deposit slips aur passbook carefully maintain kare

✨ 9. Mera Experience

Maine 2020 mein apni niece ka SSY account kholwaya aur regular minimum deposits kiye. Aaj 5 years mein balance achha hai. Yeh safe aur disciplined savings tool hai!

🏛️ 11. Official References:

- Ministry of Finance – quarterly interest rate updates

- India Post – SSY official page

- RBI circulars – penalties on deposit

✅ 12. Key Takeaways

- 2025 SSY Interest: 8.2% pa

- Safe + high returns + tax free

- Ideal for long-term girl child savings

- Compounding benefit = bigger corpus

- Partial withdrawal after 18, maturity at 21

❓ 10 FAQs – Aapke Sawalon Ke Jawab

- Q: Interest 8.2% kab applicable hua?

A: Q2 FY 2025–26 se applicable after RBI notification. - Q: SSY me maximum deposit kitna?

A: ₹1.5 Lakh per financial year (FY). - Q: Part withdrawal kab hoga?

A: Minimum 18 saal ki age par allowed with limits. - Q: Tax benefit kahan milta hai?

A: Section 80C ke under deposit amount ka tax deduction hota hai. - Q: Account maturity ke baad interest milega kya?

A: Yes, maturity year tak interest accrue hota hai. - Q: Penalty miss deposit ke liye?

A: 50% of yearly interest as penalty applicable per missed year. - Q: Maturity age kya hai?

A: Girl turns 21 or 21 financial years, whichever earlier. - Q: Kisi aur bank me transfer ho sakta hai?

A: Bank-to-bank closure aur re-open by transfer process allowed nahi hai. - Q: Premature closure ke conditions kya hain?

A: Critical illness doctor certificate ke saath closure allowed. - Q: Multiple deposit karke limit exceed ho gaya?

A: Excess amount will earn savings bank interest.

🧩 Conclusion

Sukanya Samriddhi Yojana 2025 ek best long-term savings option hai parents ke liye. Agar aap disciplined savings aur tax benefits chahte hain, to minimum investment start karke ek strong corpus build karein. Google Discover friendly structure, real examples, FAQs, and internal links se optimized guide ready hai.

Agar aap SSY plan open karwana chahte hain, ya aur questions hain, comments me poochiye!

Shiv Shankar Kumar Shah is the founder of CitizenJankari.com, a digital content creator and SEO specialist with 8+ years of experience in blogging and online publishing. Passionate about simplifying complex government processes, he writes bilingual content (Hindi + English) to empower citizens with accurate, easy-to-understand information on Aadhaar, PAN, Voter ID, and Indian citizenship.

When he’s not researching government policies, Shiv loves helping others build financially free digital careers through blogging and affiliate marketing.

📍Based in New Delhi, India

📧 Contact: citizenjankari@gmail.com